主 题:Mutual Fund Preference for Pure-Play Firms

时 间:2019年5月15日(周三)10:00-11:30

地 点:浙江大学玉泉校区经济学院236会议室

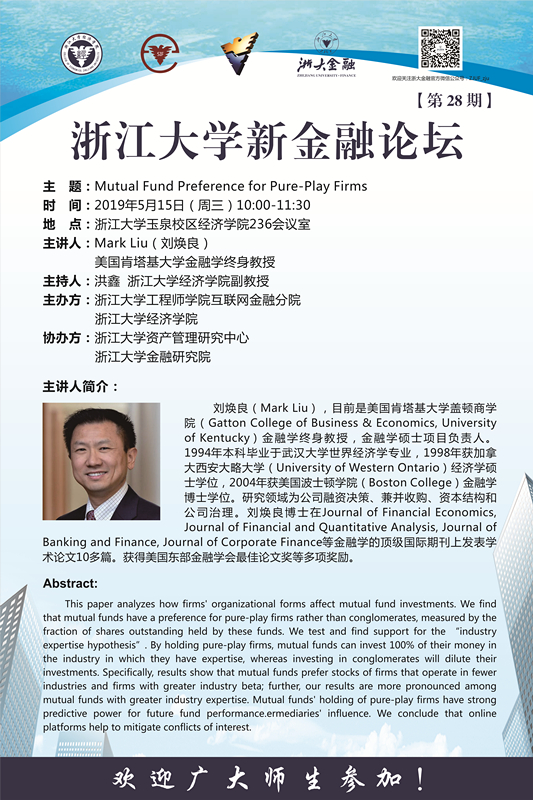

主讲人:Mark Liu(刘焕良)

美国肯塔基大学金融学终身教授

主持人:洪鑫 浙江大学经济学院副教授

主办方:浙江大学工程师学院互联网金融分院

浙江大学经济学院

协办方:浙江大学资产管理研究中心

浙江大学金融研究院

主讲人简介: 刘焕良(Mark Liu),目前是美国肯塔基大学盖顿商学院(Gatton College of Business & Economics, University of Kentucky)金融学终身教授,金融学硕士项目负责人。1994年本科毕业于武汉大学世界经济学专业,1998年获加拿大西安大略大学(University of Western Ontario)经济学硕士学位,2004年获美国波士顿学院(Boston College)金融学博士学位。研究领域为公司融资决策、兼并收购、资本结构和公司治理。 刘焕良博士在Journal of Financial Economics, Journal of Financial and Quantitative Analysis, Journal of Banking and Finance, Journal of Corporate Finance等金融学的顶级国际期刊上发表学术论文10多篇。获得美国东部金融学会最佳论文奖等多项奖励。 Abstract: This paper analyzes how firms’ organizational forms affect mutual fund investments. We find that mutual funds have a preference for pure-play firms rather than conglomerates, measured by the fraction of shares outstanding held by these funds. We test and find support for the “industry expertise hypothesis”. By holding pure-play firms, mutual funds can invest 100% of their money in the industry in which they have expertise, whereas investing in conglomerates will dilute their investments. Specifically, results show that mutual funds prefer stocks of firms that operate in fewer industries and firms with greater industry beta; further, our results are more pronounced among mutual funds with greater industry expertise. Mutual funds’ holding of pure-play firms have strong predictive power for future fund performance.